Managing insurance policies

The Insurance Policies project was developed for the Rural Union of Flores (URF), a Uruguayan cooperative company with a legacy of providing agricultural and livestock solutions since 1959. URF’s extensive services include logistical support, technical advice, and the sale of supplies, all aimed at meeting the comprehensive needs of its members.

The Challenge

URF faced significant challenges in managing its diverse portfolio of insurance policies, which range from crop insurance (hail, fire, replanting, frosts) to policies for automobiles, machinery, homes, businesses, life, and accidents. Previously, these services were handled manually, resulting in inefficiencies, lack of traceability, and challenges in customer service. Recognizing the need for a modern, efficient system, URF turned to DigitalProjex to develop a software solution that could streamline and enhance their insurance policy management processes.

The incorporation of the company DigitalProjex has been an excellent solution for us for the development of our systems. It is a very professional and qualified team, they have fulfilled the requested developments in a timely manner. In the face of demanding challenges, they have provided us with very good solutions.

The Solution

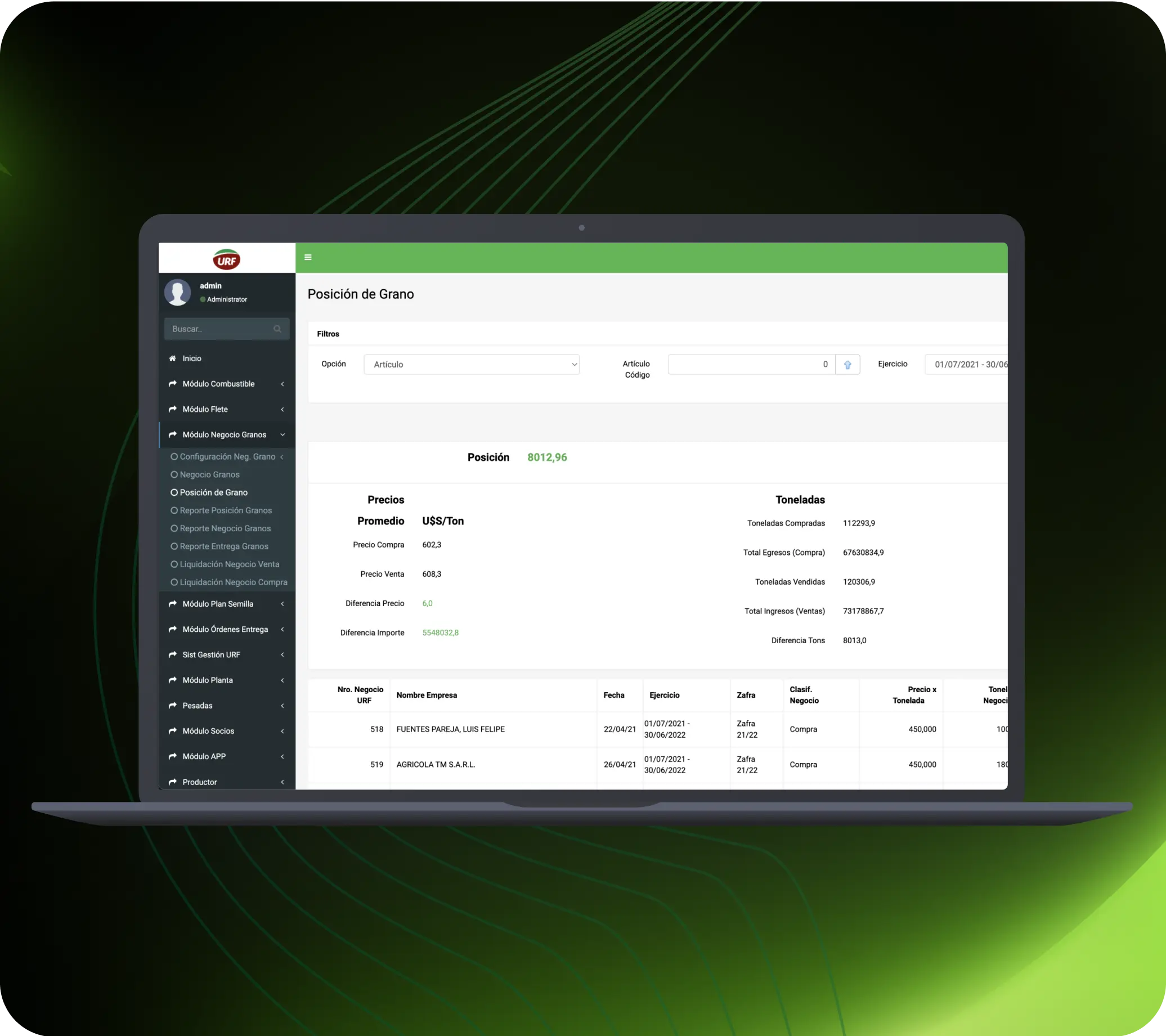

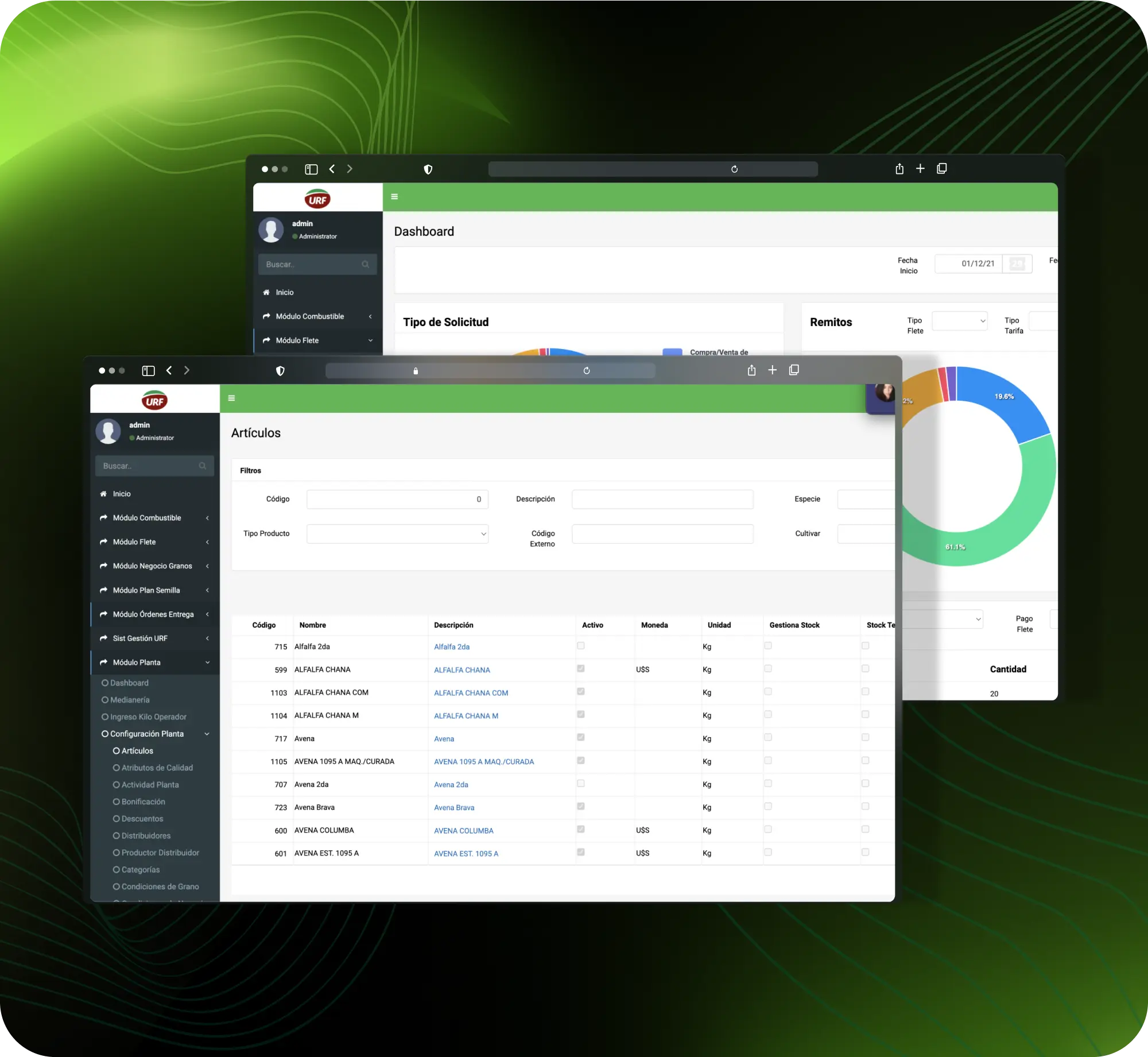

DigitalProjex designed and implemented a comprehensive insurance management system tailored to URF’s requirements. The platform includes:

Efficient tools for creating, modifying, and tracking insurance policies.

Automation of critical tasks such as payment reminders and document generation.

Robust security measures to safeguard sensitive information.

Detailed reporting features to support strategic decision-making.

A user-friendly interface for seamless navigation and operation.

Comprehensive history tracking to log all interactions with clients.

This system not only addresses URF’s operational challenges but also optimizes their insurance management processes, making them more efficient and reliable.

The Result

URF now operates with a cutting-edge system that revolutionizes their insurance policy management. Manual processes have been automated, significantly reducing administrative burdens. Employees can now focus on providing personalized service and strategic planning.

The system also enhances the ability to track individual client needs, improving customer satisfaction and ensuring compliance with regulatory standards. By optimizing operations and fostering better service delivery, the system has positioned URF to better serve its members and achieve its organizational goals.